[Editor’s Note: This is a guest post from Professor Paul Milgrom, the co-founder and Chairman of Auctionomics, is the Shirley and Leonard Ely Professor of Economics at Stanford University. According to his 2020 Distinguished Fellow citation from the American Economic Association, Milgrom “is the world’s leading auction designer, having helped design many of the auctions for radio spectrum conducted around the world in the last thirty years.”]

In a recent Twitter rant and a pair of subsequent articles in Promarket, Glen Weyl[1] and Stefano Feltri[2] invent a conspiratorial narrative according to which the academic market design community is secretive and corrupt, my own actions benefitted my former business associates and the hedge funds they advised in the 2017 broadcast incentive auction, and the result was that far too little TV spectrum was reassigned for broadband at far too little value for taxpayers. The facts bear out none of these allegations. In fact, there were:

- No secrets: all of Auctionomics’ communications are on the public record,

- No benefits for hedge funds: the funds vigorously opposed Auctionomics’ proposals, which reduced their auction profits,

- No spectrum shortfalls: the number of TV channels reassigned was unaffected by the hedge funds’ bidding, and

- No taxpayer losses: the money value created for the public by the broadband spectrum auction was more than one hundred times larger than the alleged revenue shortfall.

The seeds of the broadcast incentive auction were planted in 2007, when Apple introduced its first iPhone and other smartphones followed. By 2010, US mobile data demand had exploded and was doubling annually. The Obama administration responded with its National Broadband Plan, which emphasized the urgent need to find more spectrum for mobile broadband before growing consumer demand could overwhelm existing networks. Part of the solution would be to reallocate a portion of the spectrum that was then in use for UHF television. Like many procurements, acquiring TV broadcast rights would involve a three-way trade-off among cost, quality and timing. It would also require deciding which stations and channels to clear, what channels to assign to stations that continued to broadcast, and how to structure and allocate the new mobile broadband licenses in the repurposed portion of the spectrum.

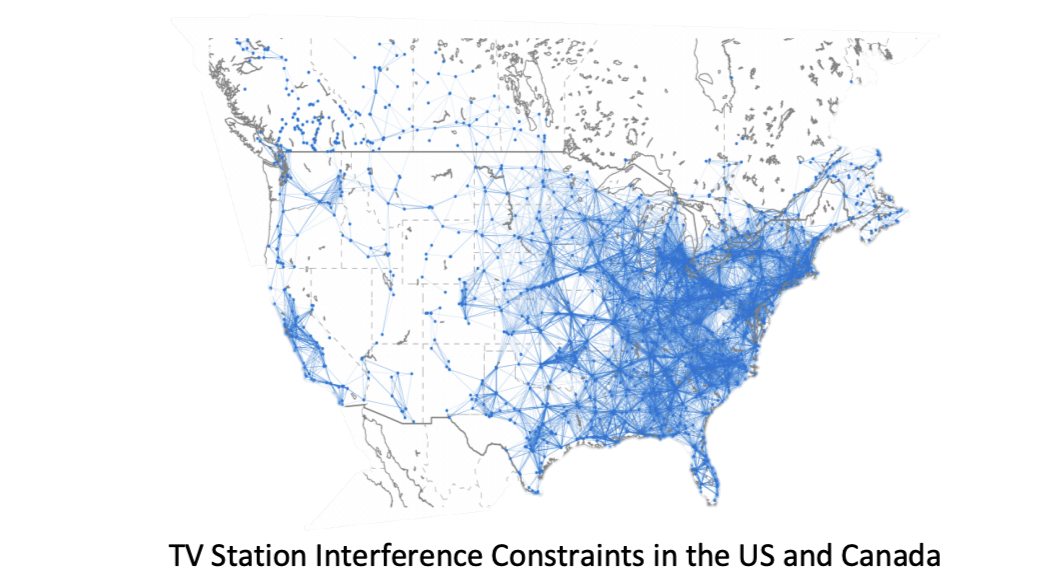

The complexity of interference patterns in the radio spectrum raised unprecedented market design challenges for which the FCC found no easy answers. The FCC asked me and my company, Auctionomics, to design the process and create critical algorithms and software. I assembled an extraordinary team to do that work[3] and the novel design and algorithms we created were widely celebrated. In a rare political consensus, the successive Democratic and Republican chairs of the FCC hailed the outcome of the broadcast incentive auction as a major success.

Weyl does not agree with those assessments. According to his article, there should have been no auction at all. He asserts that the FCC should instead have exercised its “right… to simply revoke existing licenses and then give them away or sell them to new users.” TV broadcasters who had paid for their licenses and invested in equipment, programming and audiences had heard this threat before and vehemently disagreed. The opposing parties prepared for a costly and time-consuming political and legal battle. Fortunately, Congress intervened and that outcome was avoided. Weyl contends without evidence that the compromise “promoted by Milgrom and others and written into law,” was an auction that “effectively amounted to a mass privatization of a public resource.”

Congress’s decision to mandate an auction made it inevitable that large sums of money would eventually be paid to broadcasters and their hedge fund investors in the auction. For the Weyl-Feltri conspiracy narrative to put responsibility for those sums on me and the market design community, the authors needed to invent a claim that I was an early promoter of the incentive auction, and they did so, again without regard for the facts. They offer no supporting facts for their claim because there are none. In reality, I engaged in no advocacy: no testimony or opinion articles or anything at all that promoted passage of this law.

Although I did not promote the legislation, I have expressed and continue to express my admiration for it and for the FCC staff who conceived it: Evan Kwerel and John Williams. The growth of mobile broadband in 2012 was so rapid that a spectrum shortage was looming, and a quick solution was needed. The auction was the fastest way to transfer spectrum that was politically, legally and economically viable. After all, what was the alternative? Even in the unlikely event that broadcaster rights could be quickly breached as Weyl advocates, an administrative solution would have foundered on, or at least been slowed by the need to answer difficult questions. How much spectrum should be transferred from UHF-TV broadcast to mobile broadband? Which particular stations should be required to go off air? Would they be compensated at all? How much? Might some stations switch from UHF channels to VHF to make additional space in the band? Which ones? The Auctionomics-designed incentive auction created a market to decide all these questions. It eliminated the need for a government regulator to conduct lengthy hearings and make guesses about the values of different stations and different spectrum uses in different parts of the country.

Weyl’s unrealistic process views are highlighted again by his suggestion about how the FCC could relocate license holders to new channels while preserving their existing audiences. The relocation problem is technically challenging, comparable to solving a 2000-by-2000 Sudoku, in which each move affects all the others. Yet Weyl makes the casual claim that it could have been managed by something like “a complex web of democratic participation in zoning proceedings” with legal disputes “adjudicated by courts and quasi-markets operating in the shadow of these legal constraints.” Would Weyl also recommend a similar process for designing NASA’s next missile launch? As a prominent critic of Weyl’s work, David K. Levine, has written in the Journal of Economic Literature, Weyl’s failure to grapple with the actual challenges disqualifies his proposals: “Real market designers sweat the details: they improve lives and prosperity. Listen to real market designers.”[4]

Returning to the conspiracy narrative, Weyl castigates the auction designers for secrecy. He writes that “purportedly to reduce collusion… rules were designed to make all the bidding data necessary for analysis of what had occurred in the auction secret and unavailable to the public after the auction for a period of two years [emphasis added].” Nonsense! The concealment of the bidding data neither purported to reduce collusion nor was it an attempt by the designers to hide anything: it was required by the law that authorized the auction.[5]

According to Weyl, the auction rules “made little or no provision to reduce the profitability” of the private equity firms. The opposite is true. Auctionomics’ effort to limit hedge funds’ market power is a matter of public record. In fact, the hedge funds and others fought hard but unsuccessfully to eliminate “pops scoring,” according to which lower auction prices would be offered to stations whose signal reached smaller sets of customers. Their pressure did successfully eliminate Auctionomics’ suggestion of “dynamic reserve prices,” which were designed to limit the market power of firms (especially hedge funds) that owned multiple stations in a broadcast market.

Feltri, too, claims the auction designers bolstered the hedge funds’ profits at the taxpayers’ expense. As he wrote: “Michael Dell could cash in his investment if the auction rules allowed him to do so.” However, US law forbids the FCC to adopt separate rules to discriminate against Michael Dell. Without discrimination, the mitigations described in the previous paragraph are the best ones that economic design could offer.

Feltri also challenges my personal integrity and that of the other economists involved. He writes in bold, oversized, capitalized and italicized letters that: “All the people involved assure Promarket that they never spoke to each other about the FCC auction. However, we can … confirm the absence of any Chinese wall between people active on opposite sides [underline emphasis added].” That was followed by a drum beat and innuendo: “there is no way to obtain information on private conversations.”

Just as “real market designers sweat the details,” real journalists should, too. Feltri’s “confirmed” claim and his innuendo are both contradicted by facts: there was a “Chinese wall” and there is a record of all our conversations. The FCC’s procedures enforced the wall. All presentations and verbal communications regarding the incentive auction directed to Auctionomics’ principals by interested parties were in the FCC building and, as required by law and regulations, immediately summarized in writing and filed as so-called “ex parte communications.” These ex parte filings and all written communications about the incentive auction are still publicly available in the FCC’s ex parte archive and its electronic filing system, respectively.[6]

Feltri and Weyl portray the incentive auction as a corrupt failure. Weyl calls the results “a disappointing outcome for taxpayers” and claims that the auction failed “to reallocate as much spectrum as it aimed to….” In the same echo chamber, Feltri writes that “[t]he final outcome for taxpayers was disappointing, and private equity firms made profits thanks to the design of the auction…” Contrary to Weyl’s claim, the auction reassigned exactly what it aimed to: the number of channels determined by the market based on the buyers’ and sellers’ values. Feltri does not point to any proposed or adopted provisions or rules that favored private equity firms. Why not? The auction rules are explained on the FCC website[7] and the original Auctionomics proposal is reported there, too.[8] It is fair to infer that he found nothing there.

The repeated allegations that the outcome was “disappointing for taxpayers” stumble over simple arithmetic. To estimate the value the auction created, add the $20 billion paid by the mobile broadband companies in the auction to the additional consumer surplus and producer profits in the market for broadband services. To that, add increased tax revenues from the transaction. The amounts of each of these components have been estimated in the billions or tens of billions of dollars. From the sum obtained, subtract the $10 billion paid to broadcasters, including the hundreds of millions paid to hedge funds, leaving a surplus of tens of billions. According to the authors that Weyl has cited, approximately $100 million of the hedge funds’ profits is attributable to market manipulations, in which the funds withheld some stations from the auction to increase the prices of their other stations. These alleged manipulations are substantial enough to merit attention and analysis. Even if confirmed, however, they would offset just a small fraction of one percent of the tens of billions of net value created – not nearly enough to affect the amount of spectrum reassigned or to be a major factor in assessing the success of the auction.

Turning the microscope around, let us ask: Why do Weyl and Feltri quote no industry experts to support their narrative of a failed auction? There is no difficulty finding experts with the opposite opinion. See, for example, this recent quotation from Blair Levin, director of Obama’s National Broadband Plan: “probably the single most important initiative of that plan was the broadcast incentive auction. Not only did it more than pay for the plan and many, many, many times over in terms of government revenues, more importantly, it freed up a very significant amount of spectrum.”[9]

In the opening paragraph of his Promarket article, Weyl writes that “this post corrects some mistakes I made in my tweets.” Mistakes? That is a strange appellation for fabrications and accusations of corruption. In the fashion of a flat earther, once Weyl’s initial “mistakes” were exposed, he enlisted Feltri to help him fabricate “facts,” stir in innuendo, and sweeten the mixture with misleading arithmetic to cook up their conspiratorial conclusions. Promarket’s readers deserve better.

ENDNOTES:

[1] “It Is Such a Small World: The Market-Design Academic Community Evolved in a Business Network.” Stefano Feltri, Promarket, May 28, 2020.

[2] “How Market Design Economists Helped to Engineer a Mass Privatization of Public Resources.” Glen Weyl, Promarket, May 28, 2020.

[3] The other Auctionomics professors were Stanford economists Ilya Segal and Jon Levin and UBC computer scientist Kevin Leyton-Brown.

[4] “Radical Markets by Eric Posner and E. Glen Weyl: A Review Essay,” by David K Levine, Journal of Economic Literature 2020, 58(2), 471–487.

[5] The auction secrecy rules were also good policy. If the rules had instead revealed the prices at which stations offered to sell, fewer stations would bid in the auction, leading to less competition and higher prices.

[6] See https://www.fcc.gov/proceedings-actions/ex-parte/archive-of-filings and https://www.fcc.gov/ecfs.

[7] See https://www.fcc.gov/about-fcc/fcc-initiatives/incentive-auctions/how-it-works.

[8] See https://transition.fcc.gov/Daily_Releases/Daily_Business/2012/db1002/FCC-12-118A2.pdf.

[9] See https://techpolicyinstitute.org/2020/03/24/looking-back-on-ten-years-of-the-national-broadband-plan-with-blair-levin-two-think-minimum/.

Leading Website Design Company India – Free Domain – Free Hosting | We Are Providing Low Cost Affordable Web Designing For Startups, Small & Medium Business Who Wants To Have Their Online Presence.Website Design Digital Marketing Company India – Free Domain – Free Hosting

Reliance Beauty & Health (RBH) is your reliable partner in the development of beauty and health care products that ride the latest technology and feature innovative design. Health And Beauty Products Manufacturer