Take a step back from the daily details of events. Compare the recession unfolding in the United States at this moment with the two previous downturns. Today’s economic events share a surprising set of common features with the dot-com boom and bust of 1997 to 2001, and fewer similarities with the financial meltdown of 2008-09. For reasons I will explain later, we ought to be thankful for the latter.

To be sure, these are not obvious similarities. How will be arrive at such an observation? These similarities arise from the economic processes behind triggers, transmissions, and adjustments. While that might sound like the vocabulary of a foreign language, the explanation should be intuitive to many at technology firms, who tend to be first responders to the triggers, transmissions, and adjustments of economic recessions.

The Skeleton of Recessions

A trigger is the event that interrupts an economy, usually moving it away from a path of economic growth. Money can be saved or made from foreseeing a trigger sooner than later, so analysts often jump the gun on their arrival. That said, triggers do not arise out of the ether. Usually a trigger runs counter to a prevailing view. A prevailing view is a general set of opinions and theories held by most analysts. Until the trigger arrives, the prevailing view remains largely consistent with observable facts and trends.

A trigger is the event that interrupts an economy, usually moving it away from a path of economic growth. Money can be saved or made from foreseeing a trigger sooner than later, so analysts often jump the gun on their arrival. That said, triggers do not arise out of the ether. Usually a trigger runs counter to a prevailing view. A prevailing view is a general set of opinions and theories held by most analysts. Until the trigger arrives, the prevailing view remains largely consistent with observable facts and trends.

Triggers are never completely surprises, however. Usually somebody can see the disaster coming and, unwittingly, plays the role of a modern Cassandra, with their warnings not heeded. For example, some analysts warned about unjustified valuations of startups during the dot-com boom, and some professionals foresaw the issues inherent from non-transparent and mispriced securities for sub-prime mortgages. After the fact, dissertations have been written about why their warnings caught the attention of so few listeners.

Transmission mechanisms turn triggers into recessions by either lowering demand in many parts of the economy or interrupting supply, or both, and at the same time. As an example, the dot-com bust eliminated the paper wealth of many investors, and – oversimplifying for the sake of brevity — reduced consumption and shuttered value chains affiliated with many online businesses. That led to a redirection of aggregate investment. As another example, the collapse of Lehman Brothers in 2008 generated a liquidity crisis at virtually every US bank, and – oversimplifying again – that hindered lending activity everywhere, because no bank was sure how to price risky assets. Shuttered value chains and less lending led to unemployment.

There are professional economists who spend their entire career studying every angle of every trigger and transmission in these types of events in every country that has ever experienced them. So it is necessarily an oversimplification to characterize what can happen. That said, based on watching many other countries, analysts had speculated that a major pandemic could act as a trigger for an economic recession in the US.

As this pandemic played out, the Corona Virus generated a rapid decline in consumption in the spring at restaurants, bars, stadiums, stages, parks, schools, and other places where people gather. It also interrupted supply of plenty of entertainment, among other immediate effects, as well as imposed costs on medical services in the areas where infection spiked. The reactions to this trigger have concentrated in some regions and not others, and at different times, as if Jackson Pollock painted the economic effects all over a US map. There have been myriad reactions, also typically localized.

Broadly construed, few of the adjustments to this transmission surprised  anybody. Someone who loses a job usually looks for alternatives, and if they fail, they cut back on their own consumption. If investors perceive a decline in opportunity, they usually redirect their efforts to new opportunities with better returns, or cut back on investments. Firms who foresee a decline in demand usually cut back on production, and reduce staff.

anybody. Someone who loses a job usually looks for alternatives, and if they fail, they cut back on their own consumption. If investors perceive a decline in opportunity, they usually redirect their efforts to new opportunities with better returns, or cut back on investments. Firms who foresee a decline in demand usually cut back on production, and reduce staff.

However, the economy experienced a gazillion adjustments all at once. Everywhere you look in all directions. Because everyone adjusts at the same time, that makes the sum total of this behavior difficult to forecast in the aggregate. The whole differs from the sum of its parts.

Despite that complexity, one thing always happens during these moments: News outlets and analysts find ample audiences for publicly-accessible information and analysis, because readers and viewers urgently need to adjust their behavior to match new trends. Analysts forecast, learn to reassess as events unfold, update, and keep forecasting. The hunger for updated information reaches a rare intensity.

Nobody can predict when the present hunger for information will subside, but, as in every other prior situation, it will do so eventually. I should stress “eventually.” In complicated economic times, such as in the US right now, slow adjustment towards a prevailing view is more likely than fast adjustment.

As a historical illustration, consider the emergence of a new prevailing view around the dot-com boom and bust. It is hard to remember, but the new prevailing view took a long time to emerge. The first downturn in spring of 2000 met with considerable resistance among optimistic investors, who stuck to the old prevailing view that things would bounce back. It took more than half and a year to convince most investors that revenue would not cover the costs in most of these businesses. Then investors had to relearn which metrics were prescient and which were misleading. It took several years before new startups of online firms grew again.

Updates

It will be a long time before analysts settle most open questions, and a new prevailing view emerges. As illustration for why, let’s tally some of the changes in the prevailing view in the last few months, and recognize the challenges for technology firms.

Since March there has been vociferous public debates about the trigger itself. Every firm in social media has had to follow these developments, and decide what action, if any, to take against misinformation. What is the rate of infection? (It varies by location.) Does it spread by air? (Yes, primarily this way). Do masks slow down the spread? (Yes, but some designs are better than others.) Does the summer heat kill it? (No, it is not like the flu.) Can bad cases be treated in a hospital? (Some can, but not easily). The misinformation will not cease anytime soon, least of all when a vaccine emerges, so these firms will continue to be challenged.

Another set of open question haunts the firms who supply software to organizations who permitted remote work on a temporary basis, and have begun to consider sustaining those practices. For example, Google just told its employees to work remotely through January, 2021. More broadly, the extent of experimentation has yielded a new stream of insights about best practices, and firms in the office software business have been scrambling to keep up. Don’t expect the implications for product design to settle anytime soon.

A related debate has been taking place among data carriers, who built capacity to support heavy data loads in downtown areas. Remote work this spring traffic moved data loads to residential areas during the day time. Maintenance and investment had to be redirected, and quickly. Those carriers have begun to plan for next year. Should they expect more of the same next spring? Once again, that is an open question.

As it turned out, some open questions about adjustments resolved themselves quickly. Just not many. For example, many medical practices have adopted a range of communications technologies for telemedicine consults. In light of the years of resistance to telemedicine, feel free to blame your favorite government entity for needed a crisis to finally get around to approving it. I prefer to give credit to all the effort that went into hardware and software investment that finally made this last step incremental.

In other words, just as occurred twenty years ago during the dot-com boom  and its aftermath, the conversation is urgent, extensive, constantly shifting, and unceasing. It is not confined to experts. It infuses every public square that hosts the conversation. Many technology firms find themselves altering their core strategies and actions due to changes in the frontier of that conversation.

and its aftermath, the conversation is urgent, extensive, constantly shifting, and unceasing. It is not confined to experts. It infuses every public square that hosts the conversation. Many technology firms find themselves altering their core strategies and actions due to changes in the frontier of that conversation.

Reaching a prevailing view

Frequent changes in the prevailing view, as we presently are experiencing, is a symptom of bad economic times. Good economies are much more boring.

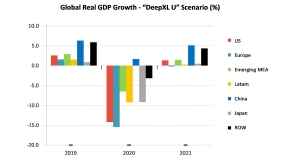

It is not as if Cassandras took over the prevailing view today, but most professionals now believe that most parts of the economy have started to decline. Here are some grim facts: The second quarter of 2020 was the worst economic quarter in the US since the 1940s, and every large bank in the US has put aside tens of billions of dollars for anticipated bankruptcies.

Unlike the financial crisis of 2008, however, there has not been any destruction from a financial panic. That could have happened, but did not. This is the sense in which the present economy resembles the financial crisis. In the spring the Federal Reserve implemented a policy to introduce liquidity into the financial system, and to help localities with their financing. The situation contained the same potential for disaster. Why not the same outcome? The Fed learned from the experience of 2009.

If policy makers had not learned, it could have been even worse. It is one of the few bright spots in an otherwise bleak situation.

Copyright IEEE Micro. To read the original, see here.

One Reply to “”